All Categories

Featured

Table of Contents

- – High-Value Accredited Investor Wealth-building...

- – Specialist Accredited Investor High Return Inv...

- – Exceptional Accredited Investor Investment Re...

- – Dependable Investment Platforms For Accredite...

- – Professional Exclusive Investment Platforms ...

- – World-Class Accredited Investor Investment N...

- – Esteemed Private Equity For Accredited Inves...

The policies for certified financiers vary amongst jurisdictions. In the U.S, the interpretation of a certified capitalist is presented by the SEC in Rule 501 of Guideline D. To be a certified capitalist, an individual has to have an annual income surpassing $200,000 ($300,000 for joint earnings) for the last two years with the expectation of making the exact same or a higher income in the present year.

A recognized investor needs to have a internet well worth surpassing $1 million, either independently or jointly with a partner. This quantity can not consist of a main house. The SEC additionally thinks about applicants to be certified investors if they are general partners, executive policemans, or directors of a business that is issuing unregistered protections.

High-Value Accredited Investor Wealth-building Opportunities

Likewise, if an entity includes equity proprietors that are certified financiers, the entity itself is a recognized capitalist. An organization can not be developed with the sole function of acquiring particular safety and securities. A person can qualify as a certified investor by showing enough education and learning or work experience in the monetary sector

Individuals that wish to be certified capitalists do not use to the SEC for the designation. Instead, it is the responsibility of the firm offering an exclusive placement to make certain that every one of those approached are accredited capitalists. Individuals or celebrations that intend to be accredited financiers can approach the company of the non listed safety and securities.

For instance, expect there is a private whose revenue was $150,000 for the last 3 years. They reported a primary house worth of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with a superior loan of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's internet worth is exactly $1 million. Considering that they meet the internet well worth requirement, they certify to be a recognized capitalist.

Specialist Accredited Investor High Return Investments for High-Yield Investments

There are a few much less usual certifications, such as taking care of a count on with greater than $5 million in assets. Under federal securities legislations, only those that are certified capitalists may get involved in particular safety and securities offerings. These might include shares in personal placements, structured products, and personal equity or bush funds, among others.

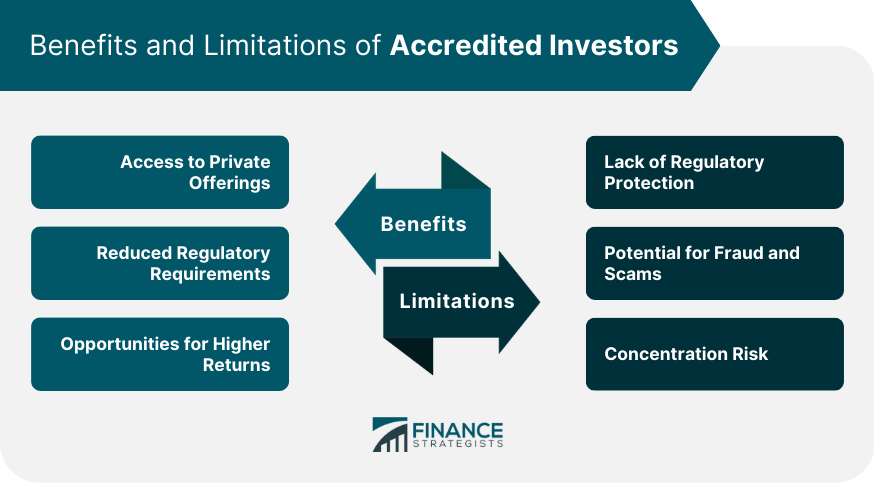

The regulatory authorities want to be particular that participants in these very high-risk and complicated investments can take care of themselves and judge the dangers in the lack of government security. The accredited capitalist rules are developed to secure prospective investors with limited economic knowledge from adventures and losses they may be sick furnished to withstand.

Certified financiers meet qualifications and expert standards to accessibility exclusive investment possibilities. Designated by the United State Stocks and Exchange Payment (SEC), they get entrance to high-return alternatives such as hedge funds, equity capital, and personal equity. These financial investments bypass full SEC enrollment yet lug greater dangers. Accredited investors must satisfy revenue and total assets requirements, unlike non-accredited individuals, and can spend without restrictions.

Exceptional Accredited Investor Investment Returns

Some crucial modifications made in 2020 by the SEC include:. Consisting of the Collection 7 Series 65, and Series 82 licenses or other credentials that reveal economic knowledge. This change identifies that these entity types are typically made use of for making investments. This modification recognizes the expertise that these staff members create.

This change represent the impacts of rising cost of living with time. These changes increase the recognized investor pool by about 64 million Americans. This larger access offers more chances for capitalists, yet additionally increases potential risks as much less financially advanced, investors can participate. Businesses utilizing exclusive offerings may take advantage of a larger pool of possible financiers.

One significant benefit is the possibility to invest in placements and hedge funds. These investment choices are exclusive to recognized capitalists and establishments that certify as an accredited, per SEC guidelines. Personal placements enable business to safeguard funds without navigating the IPO procedure and governing paperwork needed for offerings. This provides certified financiers the possibility to purchase emerging firms at a stage prior to they consider going public.

Dependable Investment Platforms For Accredited Investors for Accredited Investor Wealth Building

They are deemed investments and come only, to certified clients. In addition to known companies, qualified investors can choose to buy start-ups and promising ventures. This provides them income tax return and the chance to go into at an earlier phase and potentially enjoy incentives if the firm succeeds.

For capitalists open to the threats entailed, backing startups can lead to gains (accredited investor crowdfunding opportunities). A number of today's technology companies such as Facebook, Uber and Airbnb originated as early-stage startups supported by recognized angel capitalists. Innovative capitalists have the opportunity to check out investment options that may generate much more earnings than what public markets offer

Professional Exclusive Investment Platforms For Accredited Investors

Returns are not ensured, diversity and profile improvement alternatives are increased for investors. By diversifying their profiles with these broadened financial investment avenues accredited financiers can improve their techniques and possibly accomplish remarkable lasting returns with appropriate danger management. Skilled capitalists commonly run into financial investment options that may not be quickly readily available to the basic investor.

Investment alternatives and safety and securities provided to approved financiers generally involve greater threats. For instance, personal equity, endeavor resources and bush funds frequently concentrate on investing in possessions that lug danger but can be liquidated conveniently for the opportunity of higher returns on those dangerous investments. Researching prior to spending is important these in scenarios.

Lock up durations protect against investors from withdrawing funds for more months and years on end. Investors might struggle to precisely value personal properties.

World-Class Accredited Investor Investment Networks

This adjustment may prolong recognized financier status to a variety of individuals. Upgrading the earnings and asset standards for inflation to ensure they mirror changes as time advances. The current limits have actually stayed static because 1982. Permitting partners in committed relationships to combine their sources for common qualification as certified investors.

Allowing people with particular specialist qualifications, such as Series 7 or CFA, to qualify as accredited investors. This would acknowledge economic sophistication. Creating additional requirements such as proof of financial proficiency or successfully finishing a certified capitalist test. This could guarantee capitalists understand the dangers. Restricting or removing the key home from the total assets estimation to minimize potentially inflated assessments of wide range.

On the various other hand, it could additionally result in experienced investors thinking excessive risks that may not be appropriate for them. Existing recognized financiers might deal with boosted competition for the finest financial investment chances if the pool expands.

Esteemed Private Equity For Accredited Investors

Those who are presently thought about recognized financiers need to stay updated on any alterations to the standards and regulations. Services looking for recognized capitalists ought to remain cautious regarding these updates to guarantee they are drawing in the appropriate target market of capitalists.

Table of Contents

- – High-Value Accredited Investor Wealth-building...

- – Specialist Accredited Investor High Return Inv...

- – Exceptional Accredited Investor Investment Re...

- – Dependable Investment Platforms For Accredite...

- – Professional Exclusive Investment Platforms ...

- – World-Class Accredited Investor Investment N...

- – Esteemed Private Equity For Accredited Inves...

Latest Posts

Property Tax And Foreclosure

Foreclosure Overage

What Is Tax Lien Certificate Investing

More

Latest Posts

Property Tax And Foreclosure

Foreclosure Overage

What Is Tax Lien Certificate Investing